Drowning in debt? You’re not alone. The average American carries around $90,000 in debt across credit cards, mortgages, and loans. But here’s the thing – how you tackle that debt can be the difference between years of struggle and financial freedom.

Let’s cut through the noise. Whether you’re looking to knock out those credit card balances or finally get rid of your student loans, having a solid game plan makes all the difference. The right strategy not only helps you become debt-free faster but can save you thousands in interest.

Ready to crush your debt? Let’s break down five proven strategies that actually work, with special focus on the heavyweight championship: Snowball vs. Avalanche.

What’s the Debt Snowball Method?

The debt snowball method is all about momentum and quick wins. Think of it as the psychological hack for debt payoff.

Here’s how it works:

- List all your debts from smallest balance to largest (ignore interest rates for now)

- Pay minimum payments on everything except your smallest debt

- Throw every extra dollar at that smallest debt until it’s gone

- Once paid off, roll that payment into tackling the next smallest debt

- Repeat until all debts are wiped out

The snowball gets its name because as you eliminate each debt, your payment “snowballs” into the next one, gaining size and momentum.

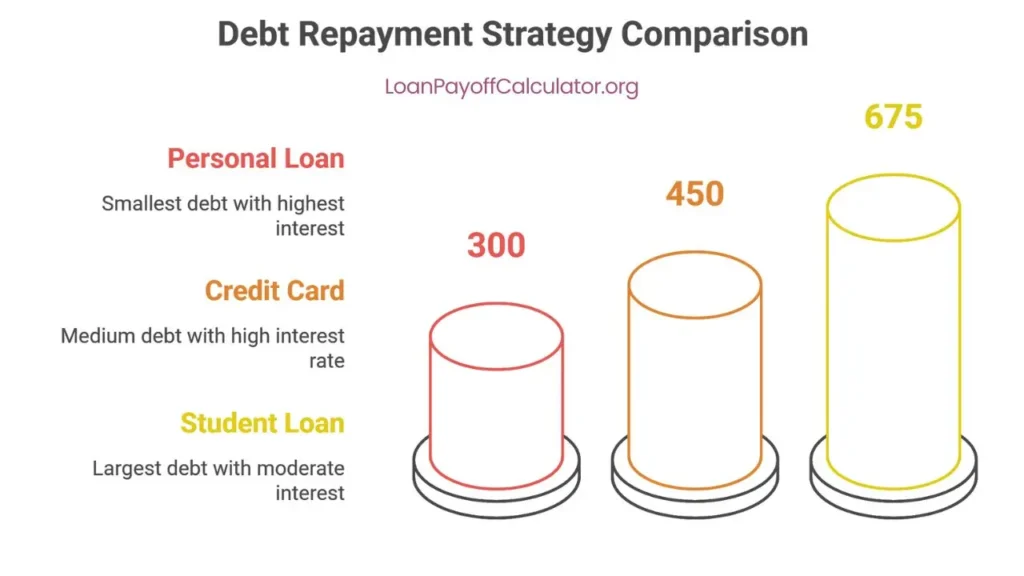

Debt Snowball Example

Let’s say you have:

- $1,000 personal loan at 10% interest ($200 monthly payment)

- $5,000 credit card at 20% interest ($150 monthly payment)

- $10,000 student loan at 8% interest ($225 monthly payment)

With an extra $100 to put toward debt each month, you’d focus on the $1,000 personal loan first, paying $300 monthly until it’s gone (about 3-4 months). Then you’d roll that $300 into your credit card payment, making it $450 monthly until that’s gone. Finally, you’d have a whopping $675 to throw at your student loan each month.

Pros of the Snowball Method

- Quick wins = more motivation: Paying off small debts creates psychological victories that keep you going

- Simplicity: Easy to understand and implement – just focus on balance size

- Fewer bills faster: Reduces the number of monthly payments you’re juggling

Cons of the Snowball Method

- Potentially more interest: You might pay more in total interest since you’re ignoring interest rates

- May take longer overall: In some debt situations, it could extend your total payoff time

Who It Works Best For

This method shines for people who:

- Need motivation to stick with debt payoff

- Have several small debts they can eliminate quickly

- Value psychological wins over pure math

What’s the Debt Avalanche Method?

The debt avalanche method is the mathematically optimal approach. It’s all about minimizing interest payments over time.

Here’s the process:

- List all your debts from highest interest rate to lowest

- Pay minimum payments on everything except the highest-interest debt

- Put every extra dollar toward that highest-interest debt

- Once it’s gone, roll that payment into the next highest-interest debt

- Continue until all debts are eliminated

Debt Avalanche Example

Using the same debts:

- $1,000 personal loan at 10% interest ($200 monthly payment)

- $5,000 credit card at 20% interest ($150 monthly payment)

- $10,000 student loan at 8% interest ($225 monthly payment)

With the avalanche method, you’d focus on the credit card debt first (highest interest at 20%), paying $250 monthly ($150 minimum + $100 extra). Once that’s paid off, you’d move to the personal loan (next highest at 10%), and finally the student loan.

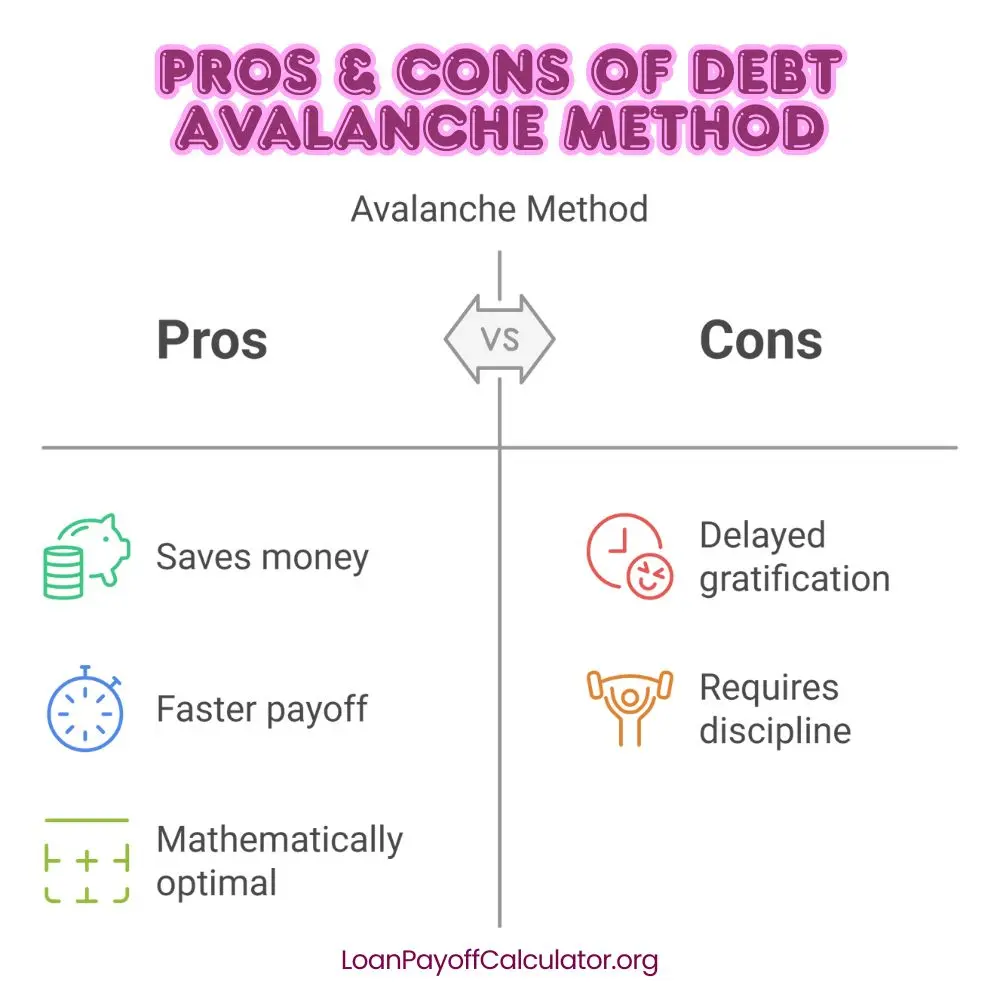

Pros of the Avalanche Method

- Saves the most money: Minimizes total interest paid over the life of your debts

- Can be faster overall: May reduce total payoff time by targeting expensive debt first

- Mathematically optimal: Satisfies the logical, numbers-focused part of your brain

Cons of the Avalanche Method

- Delayed gratification: May take longer to pay off your first debt if your highest-interest debt has a large balance

- Requires discipline: Without quick wins, some people lose motivation

Who It Works Best For

This method is ideal for people who:

- Are motivated by saving money over getting quick wins

- Have high-interest debts like credit cards

- Can stick to a plan without immediate results

Debt Consolidation Strategy

Sometimes the best way to tackle multiple debts is to combine them into one with a lower interest rate. This approach simplifies your payment structure and can save significant money on interest.

Personal Loans for Debt Consolidation

Taking out a personal loan to pay off higher-interest debts (like credit cards) can drop your interest rate from 20%+ down to 7-12%, depending on your credit score. This can save you thousands in interest and give you a clear payoff date.

Balance Transfer Credit Cards

These cards offer promotional 0% APR periods (typically 12-21 months) that let you transfer high-interest credit card debt and pay it down interest-free. Most charge a transfer fee of 3-5% of the balance, but the interest savings can far outweigh this cost.

Pros of Debt Consolidation

- Lower interest rates: Can dramatically reduce what you pay in interest

- Single payment: Simplifies your monthly bill payment process

- Fixed repayment term: Gives you a clear debt-free date (with personal loans)

Cons of Debt Consolidation

- Requires good credit: The best rates are only available to those with solid credit scores

- Potential fees: Balance transfers and some loans charge origination fees

- Risk of more debt: If you don’t address spending habits, you might end up with the original AND new debt

Debt Management Plans

When DIY methods aren’t cutting it, professional help through a debt management plan might be the move.

How Debt Management Plans Work

A credit counseling agency negotiates with your creditors to reduce interest rates and fees. You make one monthly payment to the agency, which distributes it to your creditors. These plans typically last 3-5 years.

Benefits and Limitations

- Reduced interest rates: Agencies can often negotiate rates down to 8-10% even on credit cards

- Structured approach: Creates a clear path to becoming debt-free

- Credit counseling included: Most agencies provide financial education as part of the package

However, you’ll likely need to close credit accounts enrolled in the plan, and there are typically fees involved (though usually modest compared to the savings).

Who Should Consider This Option

This approach works best for people who:

- Have primarily credit card debt

- Need professional accountability

- Are struggling to make minimum payments but aren’t ready for bankruptcy

The Hybrid Approach: Best of Both Worlds

Why choose between snowball and avalanche when you can combine them? A hybrid strategy gives you both psychological wins and interest savings.

How to Create a Customized Plan

- Start with a quick win: Pay off your smallest debt first to build momentum

- Then pivot to high-interest debt: Switch to the avalanche method to minimize interest

- Be flexible: Adjust your strategy as your financial situation changes

This approach lets you experience the motivational boost of eliminating a debt quickly, then transition to the mathematically optimal approach.

When the Hybrid Approach Makes Sense

A hybrid strategy works especially well when:

- You have one very small debt that can be eliminated quickly

- Your highest-interest debt is also one of your larger balances

- You need motivation to get started but can stick with the plan once you see progress

Calculate Your Debt Freedom Date

Ready to put these strategies into action? Our Loan Payoff Calculator helps you visualize exactly how different payment strategies affect your timeline and total interest paid.

- Compare methods: See the real difference between snowball and avalanche approaches with your actual numbers

- Track progress: Monitor your debt payoff journey with personalized projections

- Plan extra payments: Calculate how even small additional payments can dramatically reduce your debt timeline

Setting Yourself Up for Success

Having the right strategy is only half the battle. You need to create conditions that support your debt payoff journey.

Build an Emergency Fund First

Before going all-in on debt payoff, save at least $1,000 (ideally 1-3 months of expenses) for emergencies. Without this safety net, you’ll likely end up back in debt when unexpected expenses hit.

Track Your Progress

Use a debt payoff tracker to visualize your progress. Seeing your balances decrease and celebrating milestones keeps you motivated during the long journey to debt freedom.

Avoid New Debt During Payoff

The fastest way to sabotage your debt payoff plan is to keep adding new debt. Cut up cards if needed, delete shopping apps, and commit to a temporary spending freeze on non-essentials.

Increase Your Income

Even a temporary side hustle can dramatically accelerate your debt payoff. Putting an extra $200-500 per month toward debt can shave years off your journey.

Which Strategy Is Right For You?

There’s no one-size-fits-all answer to debt payoff. The best strategy depends on your specific situation:

- Choose the snowball method if: You need motivation to stay the course and have several small debts you can knock out quickly.

- Choose the avalanche method if: You’re disciplined, logical, and want to minimize the total interest you’ll pay.

- Consider debt consolidation if: You have good credit and multiple high-interest debts that could benefit from a lower rate.

- Look into debt management if: You’re struggling to make payments and need professional help structuring a payoff plan.

- Try the hybrid approach if: You want the psychological benefits of quick wins but also care about minimizing interest over the long run.

The Bottom Line

Whatever strategy you choose, the most important thing is to start. A decent plan you actually follow beats a perfect plan you never begin.

Remember, becoming debt-free isn’t just about the numbers—it’s about reclaiming your financial freedom and opening up possibilities for your future. Stay focused on your “why,” celebrate your progress, and keep moving forward.

Your debt-free life is waiting. Which strategy will you choose to get there?