How extra payments affect your loan’s interest is a question every borrower should understand. Even small additional payments can dramatically reduce the total interest you pay over the life of your loan. Whether you have a mortgage, car loan, or student debt, adding just $50 or $100 to your monthly payment might save you thousands of dollars and help you become debt-free years earlier.

According to the Federal Reserve, the average American household carries about $145,000 in debt, including mortgages, auto loans, and credit cards. What many don’t realize is that on a typical 30-year mortgage, you could end up paying nearly as much in interest as you borrowed in the first place!

Our Loan Payoff Calculator can show you exactly how much you’ll save with extra payments. But first, let’s understand the math behind how this all works.

Understanding How Loans Work

Most loans use an amortization schedule that spreads payments over the loan term. Each payment consists of two parts: principal (the amount you borrowed) and interest (the cost of borrowing).

Early in your loan, a larger portion of each payment goes toward interest rather than principal. As time passes, this ratio shifts—more money goes to principal and less to interest.

For example, on a $300,000 mortgage at 4.5% interest over 30 years:

- First monthly payment: $1,520

- $1,125 goes to interest

- Only $395 goes to the principal

- After 15 years, the same $1,520 payment:

- $668 goes to interest

- $852 goes to the principal

This payment structure explains why additional payments early in your loan term have such a big impact.

Payment Breakdown for First Year vs. Fifteenth Year:

| Payment Component | First Year (Average) | Fifteenth Year (Average) |

|---|---|---|

| Principal | 26% | 56% |

| Interest | 74% | 44% |

The Math Behind Extra Payments

Extra payments work by directly reducing your loan’s principal balance. Since interest is calculated based on the remaining principal, lowering this amount means you’ll pay less interest on every future payment.

The basic formula for calculating loan interest is:

- Monthly Interest = (Annual Interest Rate ÷ 12) × Current Principal Balance

For example, on a $200,000 loan at 4% annual interest:

- Monthly interest = (0.04 ÷ 12) × $200,000 = $666.67

If you make a one-time extra payment of $5,000:

- New principal balance = $195,000

- New monthly interest = (0.04 ÷ 12) × $195,000 = $650.00

That’s $16.67 less interest in just one month! This saving compounds over time since more of each regular payment now goes toward principal instead of interest.

A study by the Consumer Financial Protection Bureau found that borrowers who made regular extra payments reduced their loan terms by an average of 4.5 years and saved more than 17% on total interest costs.

Real-World Examples (with Calculator Screenshots)

Example 1: Mortgage Loan with Monthly Extra Payments

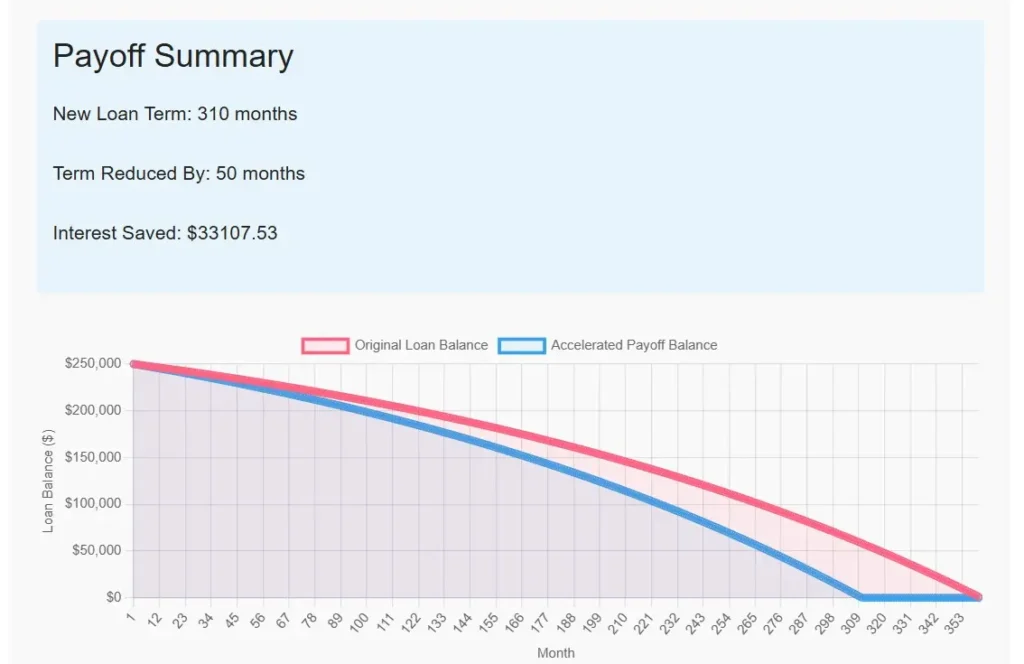

Let’s look at a $250,000 mortgage at 4.5% interest for 30 years:

- Standard monthly payment: $1,267

- Total interest paid over 30 years: $206,017

Now, let’s add just $100 extra per month:

- New monthly payment: $1,367

- Interest savings: $33,108

- Loan paid off: 4 years and 2 months earlier

Example 2: Auto Loan with One-Time Lump Sum Payment

For a $30,000 auto loan at 6% for 5 years:

- Standard monthly payment: $580

- Total interest over 5 years: $4,800

Adding a one-time extra payment of $5,000 at the end of year 1:

- Total interest paid: $3,840

- Interest savings: $960

- Loan paid off: 10 months earlier

Example 3: Student Loan with Monthly Extra Payments

For a $40,000 student loan at 5% for 10 years:

- Standard monthly payment: $424

- Total interest over 10 years: $10,911

By adding an extra $75 to each monthly payment:

Loan paid off: 1 year and 10 months earlier

New monthly payment: $499

Interest savings: $2,137

Strategies for Making Extra Payments

- Round up your payments: Make your payment an even number by rounding up. If your mortgage is $1,267, pay $1,300 instead.

- Apply tax refunds or work bonuses: Use unexpected money to make a dent in your loan principal.

- Set up automatic extra payments: Many lenders allow you to schedule additional principal payments.

- Bi-weekly payment schedule: Instead of 12 monthly payments, make 26 half-payments, effectively making one extra payment each year.

- Find money in your budget: “Skip the latte” may be cliché, but saving $4 daily adds up to $120 a month, which could save thousands on your mortgage.

Remember: Always specify that extra payments should go toward principal. Some lenders may apply extra amounts to future interest unless instructed otherwise.

Common Questions and Considerations

Watch for prepayment penalties: Some loans (particularly mortgages) include fees for paying off the loan early. Check your loan agreement before making extra payments.

Balance debt repayment with other financial goals. While paying extra on loans is usually smart, make sure you’re also:

- Building an emergency fund

- Contributing to retirement

- Paying off higher-interest debt first

As financial advisor Dave Ramsey says, “You must gain control over your money, or the lack of it will forever control you.”

If you’re trying to decide which debts to pay off first, our guide on 5 Debt Payoff Strategies: Snowball vs. Avalanche Method can help you make the right choice for your situation.

Tax implications. Remember that mortgage interest is tax-deductible for many homeowners. Paying off your mortgage faster means smaller tax deductions, though the overall financial benefit still favors extra payments.

Conclusion

The power of extra payments lies in their compound effect over time. Even modest additional amounts can lead to substantial savings and help you achieve debt freedom years ahead of schedule.

Use our Loan Payoff Calculator to run your own numbers and see exactly how much you could save. Play with different extra payment amounts to find a plan that fits your budget while maximizing your interest savings.

Your future self will thank you for the financial freedom that comes from breaking free of debt sooner. As Benjamin Franklin wisely noted, “An investment in knowledge pays the best interest,” and now you have the knowledge to save thousands on your loans.